2020 is globally a year of shocking change in almost every aspect of life. The three aspects of the COVID-19 pandemic crisis – health crisis, restrictions of movement, financial crisis – have affected and continue to affect many aspects of consumers’ daily lives, including the way they buy food and groceries. And the question everyone is concerned with is “what will happen in the near future?”. In the context of the rolling researches of IELKA, The Research Institute of Retail Consumer Goods, about the pandemic (8 waves of the research have been carried out so far) various upheavals were identified in the way of visiting retail stores, but also in the mental process of product selection.

The long road ahead

The data of IELKA surveys show a common pattern in relation to most consumer buying habits: A specific picture we had in the last 3 years, a completely different behavior during the lock-down period and immediately after, and a “weak” trend of return in the previous (pre-COVID) state. In all cases it remains unknown whether and when we will return to the previous state (with the possibility of never returning to the previous state remaining as a possible outcome).

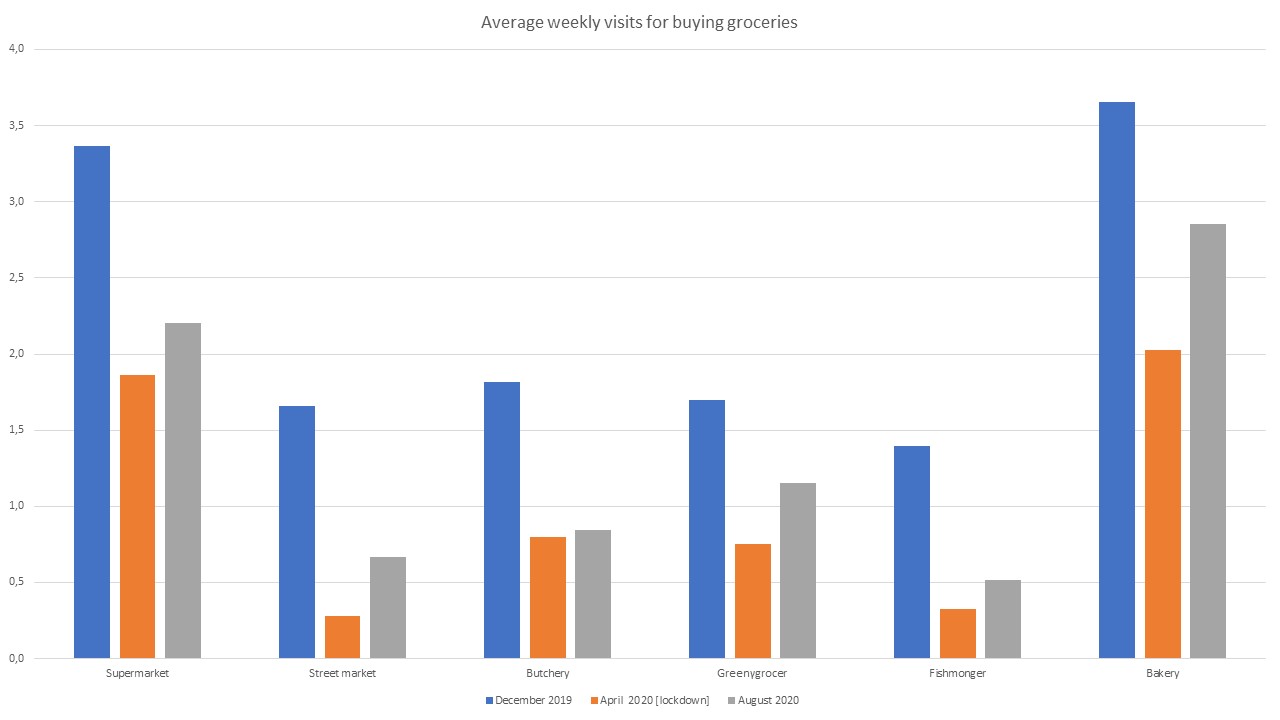

A typical example is the traffic – number of weekly visits – of food stores (see graph). The Greek grocery retail market was characterized by strong multi-channel trends with fragmented spending at different types of points of sale. This has changed dramatically in recent months, due to the appearance of the coronavirus, but also the measures to reduce crowding.

The average number of weekly visits to food stores has decreased from 13.6 in December 2019 to 8.2 in August 2020, i.e. by 40%, but shows an increase of 35% compared to April 2020, when the average number visits were just 6.1. The largest percentage change is recorded in the Fish Shops and the Street Markets (i.e. “Laiki agora”) where the visits have decreased by 63% and 60% respectively since December 2019 compared to August 2020. Especially in the case of the street market it seems that there is a relatively large blow compared with the share of consumer spending. The smallest, but still significant reductions are recorded in bakeries by 22%, in greengrocers by 32% and in supermarkets by 35%. It should be noted that there is a percentage of consumers of about 5% who now systematically choose distance shopping and mainly through the internet, something that obviously now affects the traffic of stores.

These data are indicative of the changes that the Greek market is going through and basically of how far we are from returning to the previous situation.

Threats and opportunities

The coronavirus crisis is both a threat and an opportunity for businesses. A typical example is the market of fruits and vegetables, with the blow that the popular markets have received giving growth opportunities for both the supermarket and the small, specialized points of sale.

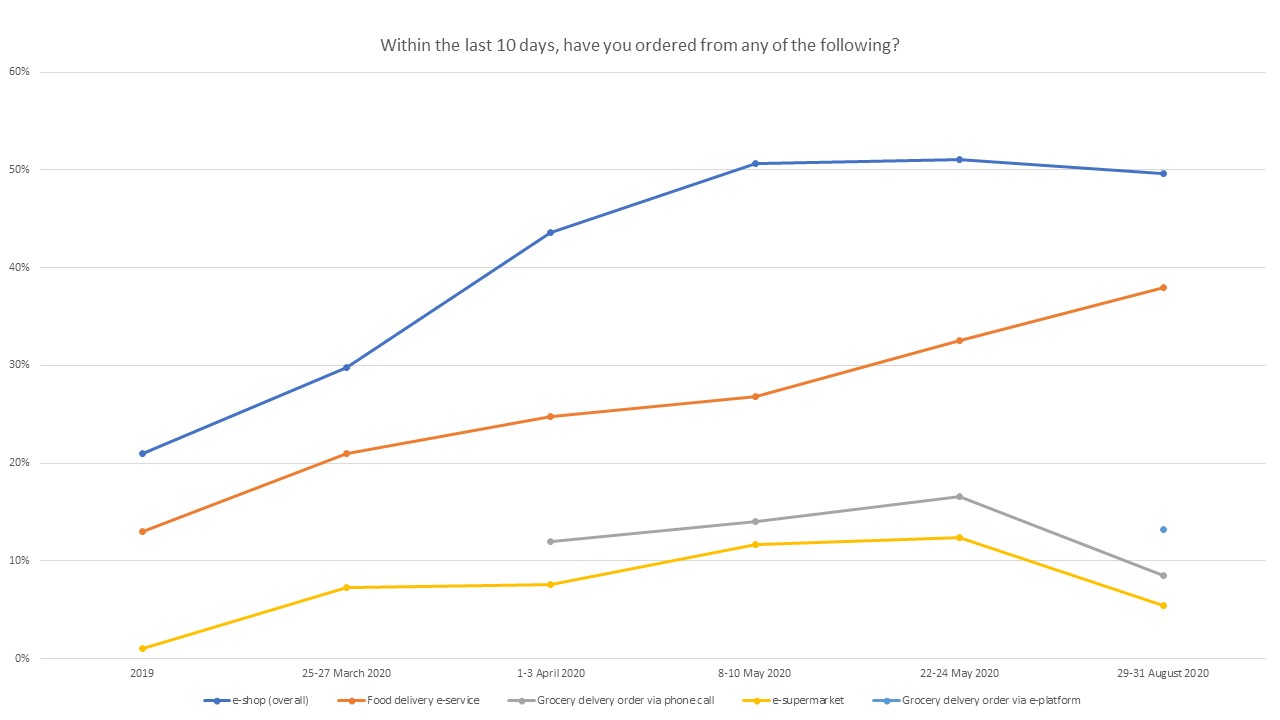

Other similar opportunities, but also bigger ones, are recorded in several other commercial aspects. The case of e-shopping is one of them, which in fact follows a completely different pattern from the previous discussion. In this case we have a specific picture that we had in the last 3 years of an almost non-existent habit, a completely different behavior during the lock-down period and immediately after and a tendency to maintain it with an unlikely return to the previous state.

In food orders from e-supermarkets (and other media), an increase of the targeted consumer share is recorded, thus strengthening the role that electronic platforms of multiple stores now play (see graph).

The three alternatives – e-supermarket, telephone ordering, multi-store platform – are estimated to be used by 25% of the public versus 29% in May, a particularly high percentage. The predominant buyers from electronic supermarkets are recorded at 5%, with an increase of 500% compared to 2019 despite the decrease compared to May, the telephone order decreases to 9% compared to 13% in May, while for the first time there is an identification of the use of electronic platform of multiple stores for ordering groceries, with a percentage of 13%. Regarding the food market in particular, the online ready-to-eat food delivery service shows a new increase reaching 38%, with a significant increase being recorded in the period after the cessation of Lockdown and the relaxation of the measures.

Supporting this development is the overall increase of e-shopping. Compared to last year, the trend of systematic purchases from online stores has more than doubled from 21% of internet users (who had made at least one online purchase in the last ten days in 2019) to 50% in August 2020, with the percentage remaining stable compared to both surveys in May.

These findings show that the initial predictions that a large part of the increase in online shopping due to the lockdown will return to the previous state, are not verified. On the contrary, there is a stabilization of the customer base of online shopping in the area of 50% of the population and about 15-20% of consumers when it comes to supermarket products.

All the aforementioned data show that developments can be treated by the market as both threats and opportunities. E.g. there is the “threat” of the entry of new “players” through online shopping, but there is also the opportunity for sales growth that is reflected in the emergence of sales through electronic platforms of multiple stores.

The developments of 2020 are taking place at an unprecedented pace and the findings of the surveys show more and more clearly that the market will not return to the previous state soon and in some aspects it will never return to the previous state. In these circumstances, companies will have to adapt and plan their strategy, with review at frequent intervals.